Rosatom unveils new SMR, facilitates import substitution through reverse engineering, transfer of uranium assets, nuclear industry at China’s “Two Sessions,” Pakistan Hualong One operational

Russia/China Nuclear Energy Digest #7

In this issue:

Rosatom has taken on new roles as the guarantor of Russia’s technological sovereignty. How is the state corporation helping Russia’s import-dependent industries evade the impact of sanctions through import substitution and reverse engineering expertise?

Countries have imposed limited sanctions on the Russian nuclear industry, though the European Union proved reluctant. What technical challenges account for Eastern European countries’ inability to diversify from Russian fuel assemblies?

Rosatom has unveiled a new small modular reactor (SMR) based on the VVER. What are its parameters and context?

Uranium One has transferred ownership of three Kazakhstani uranium mining ventures to its Russia-based holding company. What did the transfer involve, and to what end?

China’s state legislature and political advisory body have held their annual “Two Sessions” meetings. What new recommendations were raised by delegates from the nuclear industry?

Both Chinese-exported Hualong One units are now operational at Pakistan’s Karachi NPP. What is the significance of the reactor and its export?

Rosatom as Guarantor of Russian Technological Sovereignty – Import Substitution and Reverse Engineering for Sanctions Evasion

Earlier this month, Dmitri Medvedev, former Russian Prime Minister and current deputy head of the Russian Security Council, visited the Beloyarsk NPP near the city of Yekaterinburg for an official meeting with top officials in technological development, industry, and trade. The Beloyarsk facility is home to Russia’s BN-series fast neutron reactors, one of several projects Rosatom is pursuing to achieve a closed nuclear fuel cycle. Yet the meeting was not entirely devoted to nuclear innovation. As deputy head of the Security Council, Medvedev spoke extensively about information security and technological sovereignty, emphasizing Rosatom’s state-designated role as the lead organization for digital development and import substitution in critical information infrastructure. The state corporation was instructed to contribute further to Russia’s technological independence by transferring the nuclear industry’s indigenously developed digital expertise to non-nuclear sectors, including space, defense, transportation, banking, and state governance.

Medvedev meeting with other senior officials, including Rosatom CEO Alexei Likhachev, Roscosmos director Yuri Borisov, Deputy Prime Minister Dmitri Chernyshenko, Deputy Minister of Digital Development, Communications, and Mass Media Alexander Shoytov, Deputy Minister of Industry and Trade Vasiliy Shpak, head of the Federal Service for Technical and Export Control Vladimir Selin, and head of the National Center for Physics and Mathematics Alexander Sergeev | Source: Kommersant/Department of Information Policy, Sverdlovsk Oblast

While Rosatom’s core responsibility consists in the maintenance of Russia’s civil and military nuclear infrastructure, the company has also been tasked by the Russian state with the dissemination of indigenous technological solutions across all economic sectors to facilitate import substitution and mitigate the impact of Western sanctions. As a vertically integrated state corporation with experience in the development of high-tech industrial solutions, Rosatom is seen as the ideal entity to take on the critical task. Rosatom CEO Alexei Likhachev reported to Russian Prime Minister Mikhail Mishustin during a meeting in late-January that the company has been collaborating with the government to ensure the country’s “technological sovereignty across multiple domains.” It has received import substitution subsidies from the Ministry of Industry and Trade to develop indigenous equipment for the oil and gas industries and has pursued other technological innovations in energy storage, lasers, 3D printing, and hydrogen. Additionally, the state-owned nuclear giant has been facilitating the digitization of Russian industry across all sectors through the dissemination of industrial software, including product lifecycle management (PLM), computer-aided engineering (CAE), and building information modeling (BIM) systems.

Rosatom’s expertise in the development and deployment of these software systems derives from within the nuclear industry, where digital solutions were first introduced in the 1990s to automate production at select subsidiaries. Over the years, the need for modernization across the vast nuclear apparatus drove further innovation in digitalization. As sanctions threatened access to imported solutions, the digitalization process took on an increasingly autarkic character. In 2018, Rosatom released what became known as the Unified Digital Strategy, to be implemented by a specially appointed director and high-level corporate council. The Strategy consists of three components. The first is known as Internal Digitalization, referring to the digitalization of nuclear industrial processes using indigenous software – software like MULTI-D, which models the construction of NPPs in 3D while integrating schedule-, labor-, and resource-related information. According to the company, the software has already been tested during the construction of domestic NPPs and is relatively mature. Another example is the Virtual-Digital VVER developed by Rosatom subsidiary VNIIAES (All-Russian Scientific Research Institute on the Operation of Nuclear Power Plants) to enable digital simulations of VVER operation, which, in turn, can improve the training of operators and inform the modernization of NPP equipment.

Virtual VVER simulating the instrumentation and control of a nuclear power plant | Source: Rosenergoatom

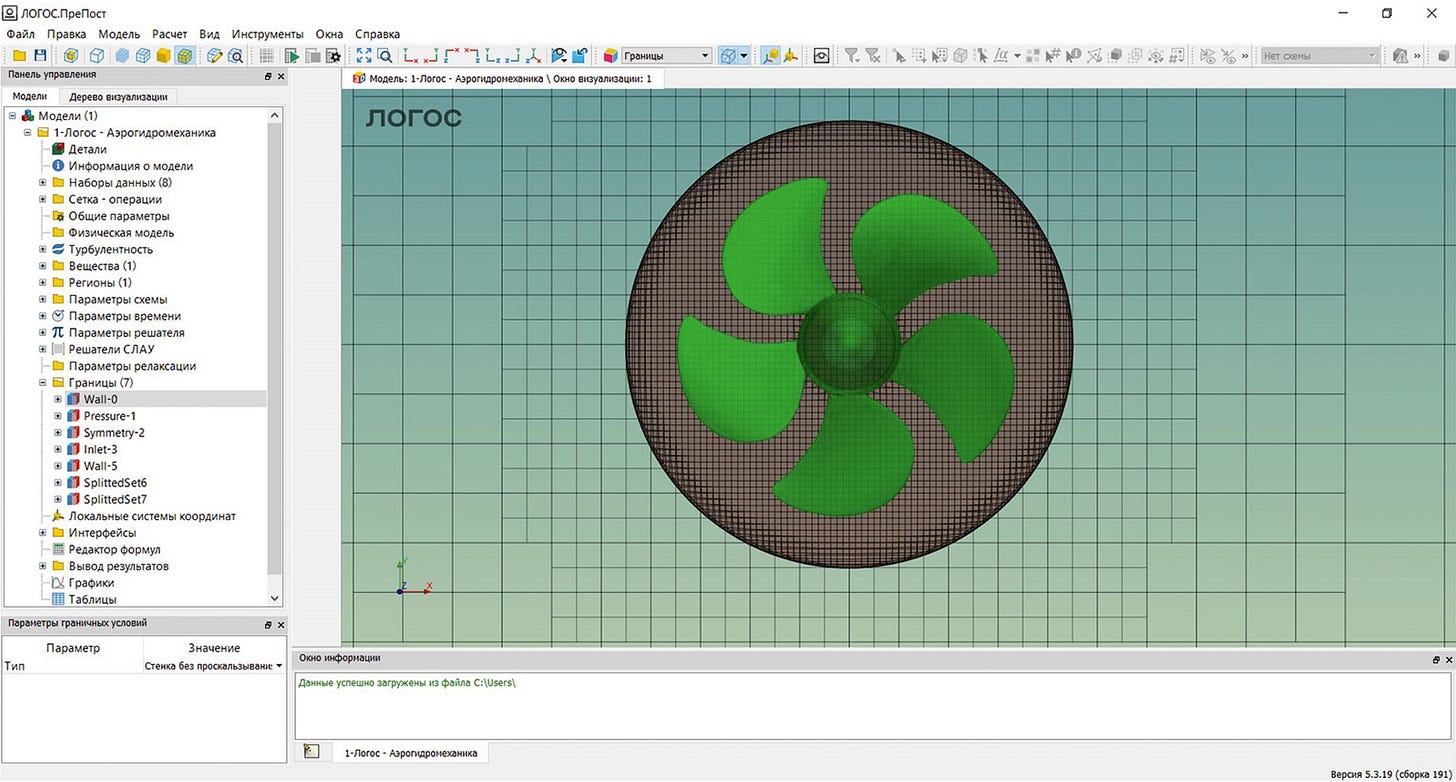

The second component of Rosatom’s Unified Digital Strategy, referred to as Digital Products, is where the aforementioned computer-aided design (CAD) and CAE software for non-nuclear sectors comes in. The goal here is for Rosatom to disseminate its digital solutions such as mathematical modeling software across the country’s key industrial sectors to achieve import-independent digitalization. In the area of CAE software, for instance, the timeline is to achieve 80% import substitution by 2027 and full elimination of foreign dependence by 2030. Some products have already been released, including Logos (Логос), an import-independent CAE software developed by the now sanctioned VNIIEF. Development began in 2009, after which the product was first adopted within the nuclear industry before being introduced to the wider market for adoption by other sectors. Another example is REPEAT (Real-time Platform for Engineering Automated Technologies), a software developed by Rusatom Service subsidiary DZhET for complex mathematical modeling in energy-related industrial applications.

As renewed sanctions deny the Russian economy access to ever broader ranges of high-tech imports, Rosatom has expanded its activities beyond the dissemination of industrial software to reverse engineering services. On February 28, the corporation’s fuel subsidiary TVEL unveiled a new service known as AtomReverse, which it refers to as a “digital product for import substitution” intended to assist “Russian industrial enterprises that operate sophisticated imported equipment and have encountered difficulties in updating, repairing, and maintaining it.” TVEL’s vice president for digitalization further described the technology as an “evolutionary version of classic reverse engineering, which is complemented by the capabilities of digital computational modeling, additive technologies and, if necessary, predictive analytics.” Such innovation in reverse engineering, according to the Rosatom executive, is “the quickest and most effective path toward technological independence under the new reality [of sanctions].” On February 17, a Russian state media outlet reported Rosatom’s collaboration with S7 Technics, the engineering subsidiary of Russia’s largest private airline, to replace foreign-manufactured parts in imported aircraft. Due to sanctions having impacted the supply of spare parts and maintenance, the airline said it was capable of repairing only 17% of imported engine components and 67% of all aircraft systems. It is in these sectors where import dependence is exceptionally high that reverse engineering is expected to be critical in alleviating the consequences of sanctions, though it remains unclear to what extent it is sufficient as a solution.

Interface of the Logos CAE software | Source: Sapr.ru

A recent Rosatom conference where Russian industrial enterprises’ transition to indigenous CAE software was discussed | Source: Rosatom

Finally, the third component of Rosatom’s digital strategy, referred to as Digital Economy, envisions contributing to the development of future technologies like quantum computing, virtual reality, additive manufacturing/3D printing, artificial intelligence, and neurotechnology to fundamentally transform the country’s economic landscape. Early last month, Rosatom subsidiary OKBM Afrikantov announced it had opened an additive technologies center to assist in the manufacturing of components for the RITM-200 reactor powering nuclear icebreakers and floating NPPs. In December 2020, Rosatom established the country’s first additive technologies center using fully indigenous solutions. It is also supporting the establishment of AI research laboratories, including at the abovementioned National Center for Physics and Mathematics, for much broader applications.

Sanctions on Rosatom as Fuel Diversification Accelerates, Inadequate Regulatory Scrutiny Bodes Ill for Safety

Western countries have imposed a wave of additional sanctions on Russia to mark the anniversary of February 24. A number of the restrictive measures were targeted at Rosatom-affiliated individuals and entities. The United States, for instance, has designated six Rosatom subsidiaries for involvement in Russia’s civil and military nuclear enterprise. Among the entities accused of developing and operating Russia’s nuclear weapons are the All-Russian Scientific Research Institute of Technical Physics (VNIITF), the All-Russian Scientific Research Institute of Experimental Physics (VNIIEF), and the All-Russian Scientific Research Institute of Automation (VNIIA). Three civil nuclear subsidiaries, including Energospetsmontazh, Trest Rosspetsenergomontazh, and the Troitsk Institute of Innovative and Thermonuclear Research (TRINITI), were designated also. Of these, the first two are responsible for the manufacturing and installation of NPP components and civil construction works while the last conducts research in controlled thermonuclear fusion and laser physics, among other areas. Finally, the Russian operating entity of the Zaporizhzhia NPP and its director, Oleg Evgenievich Romanenko are now also under sanctions.

Echoing U.S. designations, the UK likewise sanctioned VNIITF, VNIIEF, and VNIIA, in addition to the Scientific Research and Design Institute of Energy Technologies (NIKIET), for “[having] been involved in obtaining a benefit from or supporting the Government of Russia by carrying on business in sectors of strategic significance to the Government of Russia, namely the Russian energy and defence sectors.” Also sanctioned are high-level Rosatom executives including all members of the Management Board and select members of the Supervisory Board. In response, Rosatom accused the UK government of undermining a sphere of international cooperation that should remain apolitical.

In Europe, perhaps as expected, opposition from France and Hungary to Rosatom-targeted sanctions proved too difficult to overcome. The European Union’s tenth package of sanctions once again largely bypassed the Russian nuclear industry despite earlier consideration urged by the European Parliament, Ukraine, Poland, and the Baltic states. The fate of Rosatom in Europe now depends on country-level decisions. On the one hand, Hungary has pledged bilaterally with Russia to accelerate the Paks NPP project “wherever possible,” and Rosatom estimates that construction of the new units could start in earnest as early as next year. On the other hand, stakeholders of the project have become concerned the German government may refuse to allow the export of Siemens instrumentation and control equipment for the power plant, as for the Akuyyu NPP in Turkey. The Hungarian Foreign Minister have characterized the potential blocking act as one that impinges on the country’s sovereignty given the Paks NPP’s importance to Hungary’s energy security. “In case the Germans do not give permission, there are two options,” the minister said. “Either the Russians will supply the control system, or we can arrange with the French that their Framatome company take over leadership of the consortium, so the French contribution to this project will increase.”

With France still on board with Hungary to proceed with the project, the costs Europe can impose on the Russian nuclear industry remain highly limited. Frustrated by the fact, Kyiv has announced yet another round of sanctions against Rosatom and its subsidiaries as well as 200 affiliated individuals, restricting all kinds of major transactions and transit. Rosatom director Alexei Likhachev commented on the restrictive measures saying that they are “devoid of both meaning and consequences.” Although Rosatom is not critically reliant on supply chains in Ukraine, it is clear that certain linkages have existed between the two countries’ nuclear industries. According to a Rosenergoatom consultant, Rosatom was until recently reliant on suppliers in the Ukrainian cities of Kharkiv, Dnipro, and Sumy for NPP components including turbines, pumps, and other accessories. However, the consultant claims that the company has had an import substitution program in place and acquired spare components a year ahead. During the year, he said, measures will be taken to sever lingering ties.

Although all of Ukraine’s operating nuclear power plants are of the Russian VVER design, many of its VVER reactors have been supplied by Westinghouse rather than Rosatom’s fuel subsidiary TVEL, and agreements have been signed for all reactors to make the switch in the near future. The autonomy thereby afforded has allowed Kyiv to impose comprehensive sanctions on Rosatom with little reservation. A fair question is why countries like the Czech Republic and Bulgaria, which similarly operate VVER-440 and VVER-1000 reactors, are having trouble doing the same. The simple answer is that Ukraine’s transition began much earlier, meaning it has had abundant time to navigate the technical and regulatory challenges associated with a switch in supplier. To understand what challenges are currently faced by Eastern Europe’s other VVER operators, it is useful to survey the technical complexities of the VVER fuel market.

Most VVER-1000 reactors in Russia and Eastern Europe are supplied with various modifications of the TVSA fuel assembly. “TVS” is the Russian acronym for fuel assemblies (тепловыделяющие сборки, ТВС) while “A” stands for alternative construction (альтернативной конструкции). A standard TVSA assembly is a 3530mm-long fuel column with a hexagonal cross-section. The fuel rods are held together by so-called spacer grids (дистанцирующие решетки, ДР) – a total of 15 spaced out along the length of the assembly.

Components of a TVSA-12PLUS fuel assembly, one of the latest variants of the TVSA with 12 spacer grids, in addition to mixing grids that facilitate the flow of coolant | Source: OKBM Afrikantov

The combined spacer and mixing grid of a TVSA-T fuel assembly, a variant of the TVSA fuel assembly designed specifically for the Temelin NPP in the Czech Republic | Source: Jakub Juklicek and Vaclav Zelezny, “CFD Analysis of the Spacer Grids and Mixing Vanes Effect on the Flow in a Chosen Part of the TVSA-T Fuel Assembly,” Acta Polytechnica 55, no. 5 (2015): 324-328

During the last two decades, Rosatom has developed successive modifications of the TVSA in order to achieve greater fuel resilience and efficiency. The designs are advanced along three main vectors. First, a design feature known as the mixing grid (перемешивающая решетка, ПР), intended to facilitate the flow of coolant around the fuel rods and thereby improve the efficiency of the assembly, was pioneered through the TVSA-ALFA (ТВСА-АЛЬФА) design. Unlike the original TVSA, the TVSA-ALFA assembly is girded not only by 8 spacer grids, but also by 3 distinctly shaped mixing grids across its 3530mm length. Second, through the TVSA-U (ТВСА-У), and subsequently the TVSA-PLUS, Rosatom developed an elongated variant of the TVSA assembly with a higher uranium content. Both the TVSA-U and TVSA-PLUS are 150mm longer than the original TVSA. Their 15 spacer grids are distributed across a length of 3680mm rather than the original 3530mm. Finally, the third vector of modification, namely, a reduction of the number of spacer grids bracing the assembly from 15 to 12, was accomplished with the TVSA-12. The 12-spacer-grid setup is now standard across the VVER-1000 fuel assembly lineup, from the TVSA-12PLUS to the TVSA-T and TVS-2M. The TVSA-12PLUS, as may be self-evident, is a 3680mm elongated variant of the TVSA-12. With 12 spacer grids and 3 mixing grids, it is one of the latest variants of the TVSA series. The TVSA-T, on the other hand, is a variant developed specifically for the Temelin NPP in the Czech Republic as TVEL took over the supply contract from Westinghouse in the late-2000s. Building upon the TVSA-ALFA’s mixer grid innovation and the TVSA-U’s elongation demo, the TVSA-T is a 3680mm assembly using so-called combined spacer grids (CSGs) that fulfill the functions of both structural support and coolant mixing. As the variant evolved, that solution was gradually replaced by the now more standard 12-spacer-grid, 3-mixing-grid design, reflected in the TVSA-T.mod.2. Starting in 2018, unit 2 of the Temelin NPP began transitioning to the mod.2 fuel. The full transition was completed in 2021. Apart from the TVSA, which is designed by OKBM, a separate series of VVER-1000 fuel assemblies exists, designed by Gidropress. The series has evolved from the earliest TVS and TVS-M to the UTVS and finally to the latest TVS-2 and TVS-2M, primarily supplied to the Rostov and Balakovo NPPs along with the VVER-1000s in China, India, and Iran. Cutting across these designs and the TVSA variants are such innovations as debris filters, thinner cladding, and wider fuel pellet diameters.

All these technical details matter as they impinge upon the ability of Western nuclear fuel vendors, namely, Westinghouse and Framatome, to replace TVEL as the supplier of fuel assemblies to Eastern European reactors, particularly the VVER-1000s at the Temelin NPP in the Czech Republic and the Kozloduy NPP in Bulgaria. According to the agreements that have been signed, all four units will switch to the two vendors by the time their contract with Rosatom expires and their inventory of Russian-supplied fuel assemblies is depleted. Indeed, the Czech operator of the Temelin NPP has suggested that it is expecting its Western partners to begin the delivery of fuel assemblies by 2024. For Westinghouse, that deadline may not be impossible to meet. The U.S.-based company began developing its RWFA-T assembly for Temelin in 2016, in collaboration with its Czech partners. By 2019, it had loaded the first six lead test assemblies into unit 1 as part of the regulatory licensing procedure. Similarly, the company has had a contract since February, 2021, to license its VVER fuel already supplied to Ukraine for unit 5 of the Kozloduy NPP in Bulgaria.

The Temelin NPP in the Czech Republic | Source: Skoda JS

The Kozloduy NPP in Bulgaria | Source: World Nuclear News/Kozloduy NPP

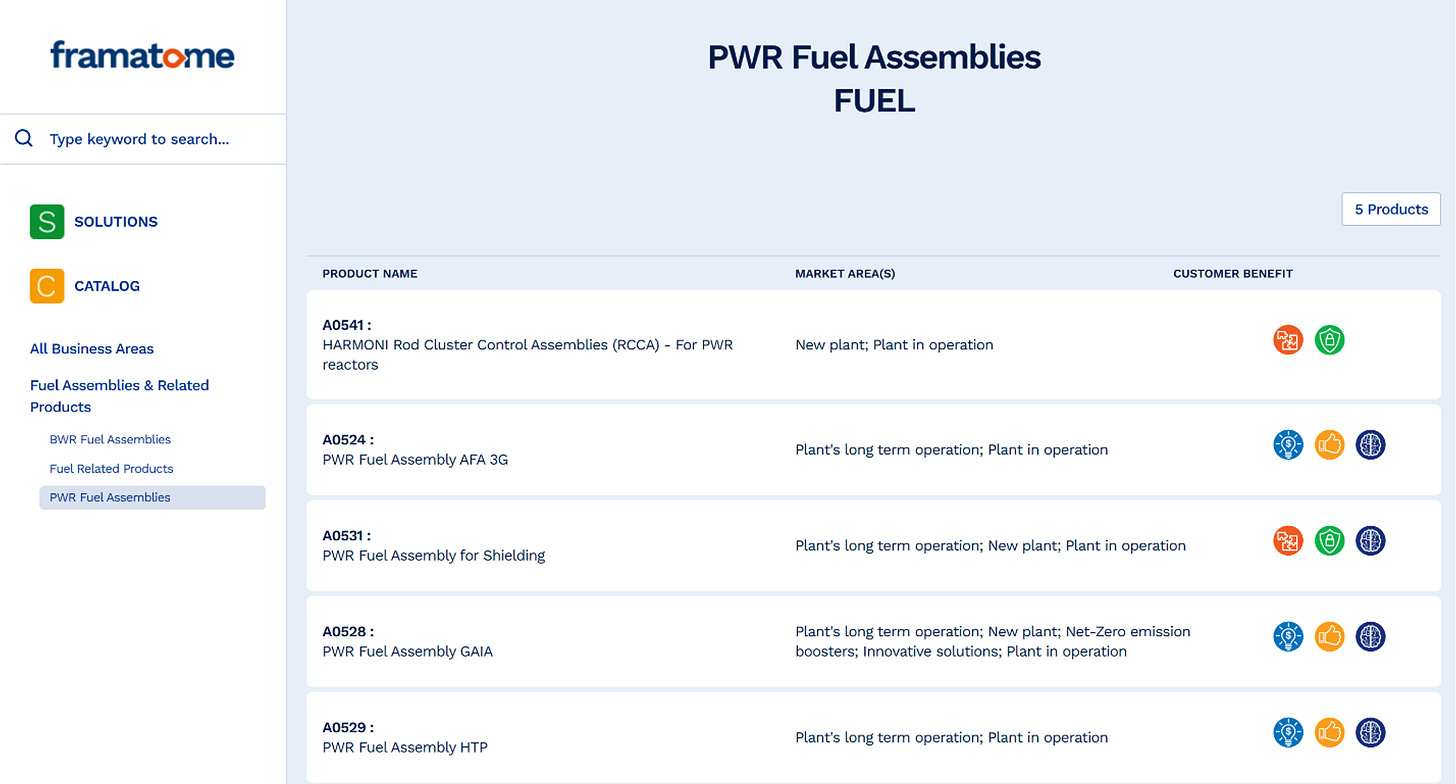

In comparison, Framatome’s timeline is much murkier. The company’s claim that its VVER fuel assemblies will require no additional licensing procedure as they are “identical” to the Russian TVSA-T for Temelin and TVSA-12 for Kozloduy-6 is not backed up by much public information. Indeed, the bid by Framatome to establish a joint venture with TVEL for fuel fabrication at the facility in Lingen, Germany, never materialized. A few days before the start of the war in Ukraine last year, Der Spiegel cited the German Minister for Economic Affairs Robert Habeck to report that the investment review application for the Framatome-TVEL joint venture at Lingen had been withdrawn. One reason, apart from the precarious geopolitical juncture, might have been the local protests to which the deal had been subjected. The Lingen facility was one of the last nuclear facilities still operating in Germany, which, at the time, was still fully committed to a nuclear phaseout. The prospect of Russian investment turning the facility into Europe’s fuel fabrication hub therefore angered anti-nuclear activists. Regardless of the reason, little information related to the joint venture has surfaced since, although the Lingen facility has apparently continued to pursue the capability to fabricate VVER fuel. According to the website of the regional Ministry for Environment, Energy and Climate Protection, the Lingen plant has applied for a license to produce “hexagonal PWR fuel assemblies,” which could only refer to VVER fuel since Western European pressurized water reactors use assemblies with square cross-sections. The head of the regional ministry has reportedly confirmed that the endeavor is intended to reduce the dependence of Eastern European NPPs on Russian fuel supplies. In any case, progress appears slow as Framatome is just now posting vacancies on its website seeking mechanical engineers for the design of “VVER assembly components, subcomponents and prototypes.” A version of events claims that the French vendor is now working on substituting Russian technology and components in its fuel fabrication operations, a process that may take several years. For diversification to be a meaningful step at all, Framatome cannot be reliant on Russian technology, components, or licensing as it becomes a fuel supplier for VVER units in the Czech Republic and Bulgaria.

If Framatome cannot supply the necessary fuel for Kozloduy-6, Westinghouse is equally unlikely to do so in the near future. Unlike unit 5, which still uses the original TVSA fuel, unit 6 of Kozloduy has switched to the TVSA-12 – of unknown compatibility with the fuel Westinghouse plans to supply. According to the former chair of the Bulgarian nuclear regulator, Georgi Kaschiev, the Westinghouse fuel that is intended for mixed-core operation with the TVSA in Kozloduy unit 5 is incompatible with the TVSA-12 currently in unit 6. While the U.S. company claimed in 2019 that it used “open source data” to ensure its RWFA-T assemblies designed for Temelin would be mechanically compatible with the TVSA-12, the alleged compatibility has not been tested. It is equally unclear whether the RWFA-T will be compatible with TVEL’s TVSA-T.mod.2 now operating in Temelin unit 2 since the six lead test assemblies that Westinghouse supplied to Temelin for licensing purposes were loaded into unit 1 rather than unit 2 of the power plant. Fortunately, in the case of Kozloduy-6, there is enough inventory of Russian fuel stored on site to sustain operation until 2027. But if Framatome is truly just beginning the development and licensing of VVER fuel, even that deadline cannot be met for certain. In fact, observers have suggested that for a newcomer to the VVER fuel market, 2030 would be a more realistic timeline for delivery.

Framatome’s current catalog of PWR fuel assemblies | Source: Framatome

Unlike unit 6, unit 5 of the Kozloduy NPP does not have an abundance of inventory. In fact, new fuel will have to be loaded as soon as early next year, according to a statement by Bulgaria’s energy minister last year. To make matters worse, the former Bulgarian regulator suggests that only specialists at Russia’s Kurchatov Institute can access the Kozloduy units’ fuel-loading system. As Westinghouse fuel gets loaded, Russian operators will need to enter the parameters of the fuel into the system to complete the fuel-loading sequence, which may not be possible as the U.S. authorities may forbid the disclosure of such parameters to Russian entities. Given the extraordinary circumstances, it is unclear how relevant the issue would be, but with sanctions starting to fall upon Rosatom-affiliated entities, similar challenges are bound to arise.

Perhaps more concerning is the prospect of hurried manufacturing and regulatory processes leading to the supply of fuel assemblies with poor safety and performance characteristics. Given Westinghouse and Framatome’s lack of experience with VVER reactors, their fuel assemblies will likely be inferior to those supplied by TVEL in terms of performance even as they are more expensive. The best one can hope for at this point is that the tight delivery timeline will not compromise the safety of the fuel. With fuel diversification becoming a political issue, national politicians are already pressuring nuclear regulators to accelerate the approval of Western-supplied reactor fuel, thus breaching their crucial autonomy. In addition, countries have uneven regulatory expertise and capacity. Bulgaria, for instance, may not have as many highly specialized and experienced nuclear regulators as the Czech Republic. Yet it is Bulgarian regulators who now face the tightest schedule to license two separate VVER-1000 fuel designs – one from Westinghouse and other from Framatome – for divergent mixed-core conditions. As regulatory agencies are compelled to cut corners while foreign fuel suppliers collude with politicians to skip the necessary licensing procedures, safety risks will become increasingly real. Past incidents of non-Russian fuel causing reactor damage in East European VVERs might repeat as a consequence.

Rosatom Unveils New VVER-Based SMR, Signs SMR Agreement with Myanmar

Russia has signed an agreement with Myanmar to jointly implement a small modular reactor (SMR) project on the latter’s territory. The signing ceremony took place in Myanmar on February 6. The two sides had previously agreed as part of a memorandum of understanding in November to carry out preliminary feasibility studies on the project.

According to Myanmar’s state media, the signing of the agreement was accompanied by a meeting between Rosatom CEO Alexei Likhachev and head of Myanmar’s military government Senior Gen. Min Ang Hlaing. The general was quoted as saying that cooperation with Rosatom will allow Myanmar to “enhance the human resources related to the construction and running of a Small Modular Reactor in Myanmar and to produce qualified experts for respective sectors.” Although there is little doubt that the civil nuclear project will proceed under safeguards, foreign media have noted that it may revive concerns related to nuclear proliferation in Myanmar considering past suspicions. Insofar as the cooperation deal consists of specialist training, a transfer of nuclear expertise will be inevitable.

The agreement signing ceremony in Myanmar | Source: Rosatom

Rosatom has developed a series of small reactors, primarily as solutions for nuclear-powered icebreakers and floating NPPs. Until recently, the company’s strategy for SMR development had been to adapt these existing designs for ground-based deployment. That appears to have changed. Earlier this year, Rosatom unveiled a VVER-based SMR known as the VVER-I. According the developers of the reactor at Rosatom subsidiary OKB Gidropress, the reactor will integrate decades of VVER design experience while at the same time being integral, modular, and compact, with natural coolant circulation and passive safety features. The thermal capacity of the new reactor will be between 250 and 400 MW while the electrical capacity will be between 85 and 140 MW, depending on the application of the reactor as well as the design of the secondary coolant loop yet to be completed. On February 8, an expert seminar on the VVER-I was held at OKB Gidropress and a discussion held among experts from Rosatom’s various research, design, construction, fuel fabrication, and export subsidiaries. In particular, the technical experts discussed the reactor’s thermal hydraulics as well as the physical and neutronic characteristics of the core. The company announcement noted that development of the reactor began last year and that younger specialists were integrated into the design team.

Small modular reactors are currently considered the future of nuclear energy development globally. Countries like the United States, whose nuclear industry based on large PWRs has suffered decline in recent years, are counting on advanced SMRs to bring about a critical revival. Yet competition is fierce. China’s PWR-based SMR is already in the equipment installation phase, and its Gen IV HTGR-based SMR has been operational for some time. The recently unveiled VVER-I based on mature VVER technology, if it can be successfully developed and deployed, will constitute yet another strong competitor to Western SMR solutions.

The VVER-I seminar on February 8 (left) and the VVER-I (right) | Source: Rosatom/Atomic-energy.ru

Transfer of Stakes in Kazakhstani Uranium Mining Ventures to Uranium One’s Russian Holding Company

The government of Kazakhstan has approved the transfer of ownership stakes in three uranium mining ventures from the Netherlands-based Uranium One Holding to the Russia-based Uranium One Group. The transferred stakes include 50% of Karatau, 30% of Khorasan-U, and 70% of SMCC. All three are joint ventures (JVs) with Kazakhstan’s national nuclear corporation Kazatomprom. According to an audit conducted at the end of 2021, the Karatau JV, which operates block 2 of the Budenovskoe deposit, controls 38,700 tU in uranium reserves while Khorasan-U, which operates Kharasan block 1, controls 36,600 tU. Meanwhile, SMCC, formerly known as Betpak Dala, controls 77,900 tU in reserves at Akdala and Inkai block 4. In terms of production, Karatau accounted for 2561 tU in 2021, Khorasan-U – 1579 tU, and SMCC – 2321 tU. Together, the three joint ventures accounted for nearly 30% of Kazakhstan’s entire natural uranium output for the year.

At first glance, the transfer of stakes seems unremarkable as there is ultimately no change in who owns the assets. Uranium One Holding is a fully owned subsidiary of Uranium One Group, which, in turn, is a subsidiary of Rosatom’s uranium trading company TENEX. The two companies are joint owners of Canadian-based Uranium One Inc., which was established as a Canadian public company in 2005. Through a series of acquisitions intimately tied to uranium assets in Kazakhstan, Uranium One Inc. became a majority-owned subsidiary of Rosatom in 2010 and was fully owned by the Russian state corporation from 2013 onward. Through its various subsidiaries, Uranium One owns shares ranging from 30% to 70% in a total of five uranium mining JVs in Kazakhstan, second only to Kazatomprom in terms of Kazakhstani uranium reserves under its control. The latest transfer of some of these assets, while it could have been an ordinary commercial maneuver “to optimize the corporate ownership structure of uranium mining assets” and “simplify the asset management system,” as declared by Uranium One, could also have been driven by a desire to divert the most important assets from Western-based subsidiaries.

Kazakhstan’s uranium deposits, including Kharasan in the south, Budeonovskoe, in the middle, and Akdala/Inkai in the north | Source: World Nuclear Association/Kazatomprom

Recommendations Presented by Nuclear-Industry Delegates at China’s “Two Sessions”

The plenary sessions of China’s national legislature and political advisory mechanism, traditionally labeled the “Two Sessions,” opened on March 4-5. The annual gatherings of members and delegates within the National People’s Congress (NPC) and Chinese People’s Political Consultative Conference (CPPCC), as the legislative and advisory bodies are respectively known, are reserved both for formalistic procedures like the ratification of legislation and for the submission of bottom-up policy proposals by delegates, each representing the interests of their affiliated industry and institution. Of those that attended this year’s sessions, at least twelve represented the nuclear industry or nuclear-adjacent entities. The following is a list of the members and delegates as well as their policy recommendations.

Luo Qi (NPC Delegate | Chief Engineer, CNNC) in his recommendation “On High-Flux Fast-Neutron Research Reactors” suggested the construction of a high-flux fast-neutron research reactor at the earliest possible time in order to satisfy advanced nuclear research needs and significantly reduce the development cycle of advanced nuclear fuel and material.

Liu Shipeng (NPC Delegate | Deputy Chief Engineer & CEO of 404 Corporation, CNNC) and Shi Yancai (NPC Delegate | Maintenance Welder, CNNC) in their recommendation “On Establishing National Nuclear Science Day” proposed designating September 27 China’s National Nuclear Science Day to commemorate the launch of the country’s first heavy water reactor and cyclotron on September 27, 1958.

Shi Yancai (NPC Delegate | Maintenance Welder, CNNC) in his recommendation “On the Competitiveness of Nuclear Energy Exports” urged the state to expand financing mechanisms and increase support for nuclear energy exports through fiscal, tax, financial, and insurance benefits.

The closing of the Two Sessions in Beijing’s Great Hall of the People, March 13 | Source: Xinhua News Agency

Lu Tiezhong (CPPCC Member | CEO of China National Nuclear Power, CNNC) and Xu Pengfei (CPPCC Member | CEO of China Nuclear Power Engineering, CNNC) in their recommendation “On the Deployment of High-Temperature Gas-Cooled Reactors (HTGRs) for Multiple Applications According to Regional Comparative Advantage” suggested the coupling of HTGR technology with industrial enterprises, arguing that such energy-intensive sectors as petrochemical and steel production currently account for high coal consumption and pollution and could especially benefit from coupling with HTGR deployments. They also suggested launching nuclear power to provide baseload in provinces that are net exporters of renewable energy.

Xin Feng (CPPCC Member | CEO of China Nuclear Energy Industry Corporation, CNNC) in his recommendation “On Strengthening Geological Work Surrounding Uranium Deposits in Renewed Strategic Operation to Achieve Prospecting Breakthrough” suggested building domestic capacity in uranium prospecting and deposit development to ensure adequate autonomous fuel supply for the country’s nuclear expansion. In addition, in his recommendation “On Supporting Export Tax Refunds for the Country’s Low-Enriched Uranium Products,” Xin called on the government to implement policies in support of China’s low-enriched uranium exports such that they may complement exports in nuclear energy technology. He revealed that the China Nuclear Energy Industry Corporation, as China’s only nuclear fuel manufacturer and supplier, has implemented large-scale modernization and reforms during the past three years to lower its costs and increase its competitiveness, particularly on the international market, where it is gradually gaining the ability to compete.

Han Yongjiang (CPPCC Member | CEO of Tsinghua Tongfang) echoed NPC delegates’ recommendations “On the Competitiveness of Nuclear Energy Exports” and “On High-Flux Fast-Neutron Research Reactors.”

Duan Xuru (CPPCC Member | Chief Technical Expert for Fusion Reactor Power Plant, CNNC) in his recommendation “On Perfecting and Adapting Legal and Regulatory Standards for Developing Nuclear Heating Reactors” indicated that the safety and ecological regulations for nuclear heating reactors are lacking and urged the establishment of a system of standards in site selection, design, approval, and oversight.

Yang Changli CPPCC Member | CEO, China General Nuclear Power Corporation) in his recommendations “On Increasing the Intensity of Nuclear Energy Development, Expanding New-Builds Inland, and Promoting Nuclear Heating Applications,” presented jointly with 14 other members, suggested it would be necessary to maintain a new-build approval rate of at least ten units per year for the next ten years to address the shortage of clean baseload electricity in inland regions that at the same time face the challenges of high pollution and carbon emissions. Yang noted that China currently has 76 nuclear power units in operation or under construction, with a total capacity of 81 GW, although nuclear power’s share in the national energy mix is still relatively insignificant, at 2.2% of installed capacity and 5% of annual electricity generation – less than one half of the world average and one third of the average in developed countries. According to his estimates, nuclear-generated electricity must occupy 10% of all annually produced electricity by 2030 and 18% of all annually produced electricity by 2050 in order for China to meet its emissions reduction targets. China’s NPPs are all currently dispersed along the coast. Arguing in favor of inland deployment in the future, Yang referenced advanced nuclear countries like the United States, France, and Russia, all of which have deployed the majority of their nuclear power units in inland regions. Yang claims that China’s indigenous Hualong One technology is among the safest and most advanced in the world and that an abundance of feasibility studies have been done in recent years surrounding the main safety and ecological challenges of inland deployment. In addition, Yang hopes the nonpower applications of nuclear units such as urban heating, desalination, and hydrogen production may be explored as soon as conditions allow.

Qian Zhimin (CPPCC Member | CEO, State Power Investment Corporation) made recommendations related to technological innovation and corporate governance.

Wang Mingdan (CPPCC Member | President, Shanghai Nuclear Engineering Research and Design Institute, SPIC) suggested that nuclear power continues to be the only scalable alternative to coal-generated baseload power and that China should strive for the global average of having 10% of its electricity being derived from nuclear power by 2035. Related to the CAP1400/Guohe One, the Hualong One alternative developed by SPIC on the basis of the AP1000, Wang revealed major progress with respect to indigenization. According to him, all equipment used in the advanced Gen III reactor will be indigenized within the year. In addition, the Shanghai Nuclear Engineering Research and Design Institute is developing small and mobile reactors capable of more flexible deployment to complement the large reactor design.

Wen Shugang (CPPCC Member | CEO, China Huaneng Group Corporation) presented recommendations related to the acceleration of renewable energy and energy storage development.

Both Hualong One Units Now Operational at Pakistan’s Karachi NPP

Unit 3 of the Karachi NPP in Pakistan began operating on February 2, marking the completion of China’s first overseas Hualong One project. Two units of the 1000MW Gen III pressurized water reactor were built under the project. The first unit, or unit 2 of the Karachi NPP, entered commercial operation in May of 2021. Pakistan is the only country to have imported Chinese reactors. Four additional units were exported from China to Pakistan prior to the Karachi deal. As the Chinese nuclear industry seeks to intensify its “going out” campaign, the Hualong One will be its primary candidate for export, and the project in Pakistan provides key demonstration of the unit’s safety and efficiency as well as its Chinese vendor’s ability to deliver abroad on time and on budget.

The K-2/K-3 units at Pakistan’s Karachi NPP | Source: Xinhua News Agency/CNNC

Coincidentally, the Hualong One became the inspiration of a C-drama that recently premiered on Channel One of China’s state-owned television. Produced with participation from CNNC, the 32-episode series Enlighten Your Life traces the growth of China’s civil nuclear industry from the 1980s through the Hualong One’s research and development. Main conflicts in the plot, apart from ordinary drama, include key deliberations over the core design of China’s first indigenous PWR and the frustrations of Fukushima.

Posters and scenes from Enlighten Your Life | Source: YouTube

Why VVER-1 if RITM-200/400?