Progress on advanced reactors, nuclear fuel by Russia and China, U.S. facing dependence constraints, Kazakhstan as assembly exporter, nuclear power in Middle East

Russia/China Nuclear Energy Digest #5

In this issue:

Rosatom has made significant strides in the development of advanced nuclear fuel. What are its latest innovations?

China is making progress on advanced modular reactors – the technology explained

Kazakhstan has exported its first batch of fuel assemblies, enabled by Chinese investment and market access; its uranium exports continue, more often bypassing Russia

The United States may lag behind in the development of advanced nuclear reactors due to dependence on Russian-supplied nuclear fuel

Russia bids for Saudi nuclear power project; China vows further cooperation with Gulf countries in nuclear technology and security

Rosatom Develops New Nuclear Fuel for PWRs, Fast Reactors, and Floating Units

Rosatom has successfully manufactured the test fuel assemblies for the BN-1200 fast neutron reactor soon to be constructed at the Beloyarsk NPP. The assemblies are expected to be loaded into the smaller BN-600 reactor for testing next year. The BN series of sodium-cooled fast reactors is key to the Russian nuclear industry’s efforts to achieve a closed fuel cycle, which refers to the recycling of uranium and plutonium resources that otherwise would become waste.

Unlike traditional fuel assemblies containing uranium oxide, the newly produced test assembly is fabricated using what is known as mixed uranium-plutonium nitride fuel (смешанное нитридное уран-плутониевое/СНУП-топливо). It utilizes plutonium as well as uranium, as its name suggests, thereby enabling uranium savings. Meanwhile, its nitride form gives it greater density compared to oxides, allowing for a more compact reactor core, which, in turn, enhances the breeding of fissile materials from generally abundant uranium-238. Furthermore, nitride fuels offer higher thermal conductivity compared to the oxide fuels currently in use, making the operation of the reactor safer and more efficient. When used in sodium-cooled reactors like the BN-600 and BN-1200, nitride fuel enables additional safety as it does not react chemically with the sodium coolant the same way oxide fuel does. According to current plans, both the BN-series sodium-cooled fast reactors and the BREST-OD-300 lead-cooled fast reactor currently under construction in Seversk will transition to the mixed nitride fuel, although the structural materials used in the assemblies for the two types of reactors will differ.

Apart from the nitride variation, Russia is currently in the process of developing and deploying several other types of mixed uranium-plutonium fuel. One designed for thermal reactors is known as REMIX-fuel (РЕМИКС‑топливо) and consists of low-enriched uranium and plutonium. Another is a mixed-oxide, or MOX, fuel (МОКС-топливо) designed for fast neutron reactors and consisting of depleted uranium and plutonium – the latter in the much higher proportion of around 30%. The Russian nuclear industry is currently most advanced in MOX-fuel development. In September, the 820MWe BN-800 reactor at Beloyarsk transitioned fully to MOX-fuel assemblies, marking what stakeholders called “a long-anticipated milestone” for the industry.

REMIX-fuel development is not lagging far behind. Last month, Senior Vice President of Rosatom’s nuclear fuel division TVEL Alexander Ugryumov revealed that the company’s fifth-generation TVS-5 assemblies for the VVER pressurized water reactor will eventually utilize a uranium-plutonium REMIX-fuel. The assembly will be developed in two stages – a first stage involving the testing of the assembly using conventional uranium oxide fuel, starting next year, and a second stage entailing the production of mixed-fuel assemblies at the Siberian Chemical Combine by 2025. Once developed, the assemblies will allow the loading of reprocessed uranium and plutonium fuel into both the VVER-1000 and the third-generation VVER-1200 pressurized water reactor. Furthermore, their fabrication will be completely automated, like the fabrication of fast reactor fuel assemblies. Together, the REMIX, MOX, and nitride fuels are envisioned to help the Russian nuclear industry achieve its stated objective of “dual-component nuclear energy generation with thermal and fast reactors in a closed nuclear fuel cycle” (двухкомпонентная атомная энергетика с реакторами на тепловых и быстрых нейтронах, работающими в замкнутом ядерном топливном цикле), which, in short, refers to the ability to use recycled uranium and plutonium across all types of power reactors.

Significantly, these mixed uranium-plutonium fuels may allow a more secure process for the recycling of spent fuel compared to the currently wide-spread plutonium-uranium extraction, or PUREX, method. The latter involves the separation of spent fuel into uranium and plutonium and, given the potential for separated plutonium to be used in nuclear weapons, produces a proliferation concern that constitutes one of the strongest arguments in the case against the reprocessing of nuclear fuel. If the need for uranium-plutonium separation, on the other hand, can be eliminated with mixed fuels, that concern can be significantly alleviated, in addition to the potential efficiency gains.

The newly manufactured uranium-plutonium nitride fuel rod | Source: Rosatom

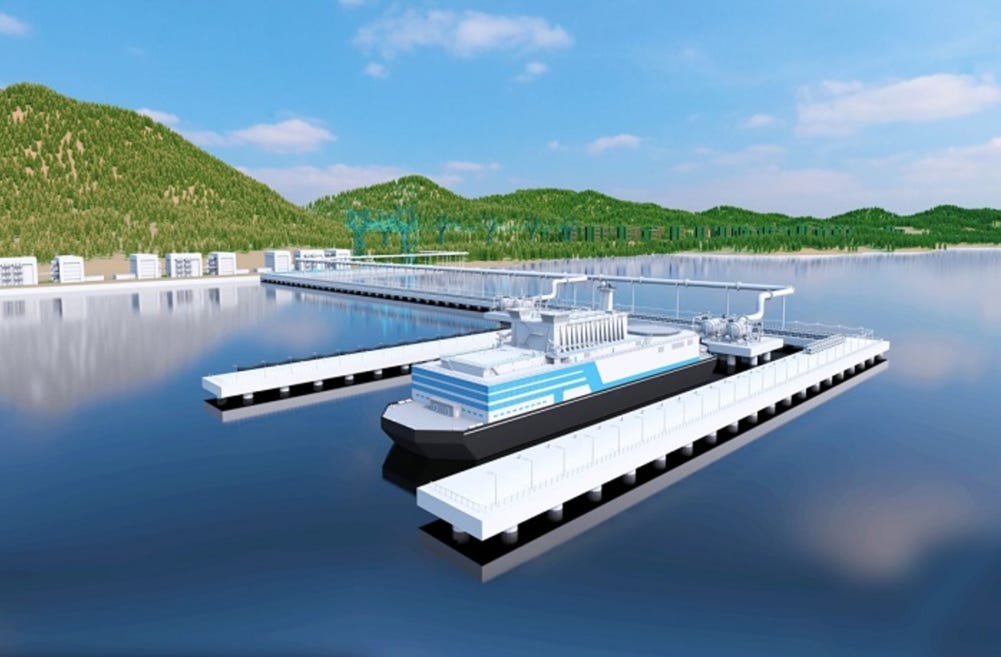

In a separate development, Rosatom subsidiary OKBM Afrikantov has finished designing the fuel for a new generation of small nuclear reactors – the RITM-200S – for the modernized floating nuclear power unit (модернизированный плавучий атомный энергоблок/МПЭБ). These power units are designed to supply electricity to remote mining operations in the Arctic region. Four units are currently planned, each to be equipped with two 198MWt RITM-200S reactors. Compared to the Akademik Lomonosov representing the current generation of floating nuclear power plants, the new units would be safer and more efficient economically, according to Rosatom.

The modernized floating nuclear power unit | Source: Rosatom

China Makes Further Progress on High-Temperature Reactor, SMR

China’s modular high-temperature gas-cooled reactor (HTGR) plant at Shidaowan (石岛湾), Shandong Province, reached full power on December 9, exactly ten years after its construction began. Referred to as the HTR-PM, the plant is the world’s first fourth-generation HTGR demonstration facility to operate at full capacity. It consists of two reactors jointly powering a single steam turbine, generating up to 200 MWe of power. Its modular design means that its power can be easily scaled up at the commercialization stage through the addition of further reactors. By confirming the feasibility of configuring multiple reactors to power a single turbine, the success of the demonstration plant paves the way for the 600 MWe commercialized unit envisioned with up to six HTGRs of the same design and parameters. Development of the commercial unit, known as the HTR-PM600, has already begun.

3D model of the commercial HTR-PM600 with six HTGRs and their steam generators arranged in circular fashion | Source: Zhang et al., “600-MWe High-Temperature Gas-Cooled Reactor Nuclear Power Plant HTR-PM600,” Nuclear Science and Techniques 33, no. 101 (August, 2022).

Nuclear island layout of the HTR-PM600 | Source: Zhang et al., “600-MWe High-Temperature Gas-Cooled Reactor Nuclear Power Plant HTR-PM600,” Nuclear Science and Techniques 33, no. 101 (August, 2022).

HTGRs are one of the six most promising fourth-generation reactor designs being developed by countries around the world and are more advanced than the second- and third-generation power reactors in current operation along a list of criteria including safety, economics, and proliferation resistance, among others. The Chinese HTGR is of the pebble-bed design, meaning its fuel is fabricated in the form of billiard ball-sized graphite spheres embedded with uranium particles coated by ceramic materials for integrity. The spheres – called pebbles – are dropped into the core to heat up the helium coolant, which then goes to generate steam. With a high enough coolant temperature, HTGRs can be used to produce not only electricity, but hydrogen and industrial heat as well – an added advantage of the design compared to conventional light-water reactors.

The Shidaowan HTR-PM demonstration project | Source: CCTV

Installation of the steam generator for the HTR-PM | Source: CCTV

Fuel pebbles for the HTR-PM | Source: CCTV

In another part of China, installation work has begun on the nuclear island of a small modular reactor unit using light-water technology, namely, the ACP100, also known as the Linglong One. The 125MW unit is claimed to be the world’s first commercial small modular reactor (SMR) to be built on land. Overall construction began in July of last year and is expected to take a little less than 5 years. The current stage of work involves the installation of key equipment in the nuclear island such as the reactor pressure vessel and steam generator. Compared to larger nuclear power units, usually rated 1000 MW and above, SMRs are expected to be safer and more flexible to deploy. Plants can be quickly scaled up in capacity through the deployment of additional modular units, and power generation can be supplemented by desalination and heating functions.

Kazakhstan Delivers First Batch of Fuel Assemblies to Chinese NPP, Diversifies Uranium Export Routes Bypassing Russia

Kazakhstan’s national civil nuclear company Kazatomprom has announced the first successful delivery of its domestically fabricated nuclear fuel assemblies to a foreign nuclear operator – a development that marks the Central Asian country’s transition from a natural uranium supplier to a manufacturer of higher value-added nuclear fuel products. The Ulba fabrication plant that produced the assemblies is a joint venture between Kazatomprom and the Chinese state-owned nuclear corporation CGN. Technology and licensing are provided by France’s Framatome.

Kazakhstan has long sought to upgrade its nuclear industry through foreign investment and technology transfer. Since the mid-2000s, the country has tried repeatedly to leverage its natural uranium resources to pursue joint ventures with foreign partners in order to gain a foothold in the international nuclear fuel and power generation markets. In December of 2014, Kazatomprom signed a framework agreement with CGN to construct a facility for the fabrication of Framatome’s AFA 3G nuclear fuel assemblies for the CPR1000 reactors that CGN operates in China. Production began on November 10, 2021. Capacity is expected to reach around 200 tU per year.

Shipment of Kazakhstan’s first batch of domestically fabricated nuclear fuel assemblies | Source: Kazatomprom

Meanwhile, as a country with abundant uranium resources, Kazakhstan is continuing its traditional business of natural uranium export. Whereas its exports traditionally cross into Russia to be shipped off from the port of St. Petersburg, sanctions-related complications have urged a reexamination of alternatives. Earlier this month, Kazatomprom announced the delivery of its uranium to Canada through the trans-Caspian route bypassing Russia. The corridor was first developed in 2018, when the port of St. Petersburg briefly halted nuclear material shipments due to the city’s obligation of hosting the FIFA World Cup. Kazatomprom’s Canadian partner earlier announced a temporary halt to the shipment of uranium products from Kazakhstan until the finalization of “an alternative route avoiding Russian railway lines.” Kazatomprom, on the other hand, said it was not having trouble with its own shipments but admitted that it was “working to reinforce its alternative Caspian Sea route” bypassing Russia.

Dependence on Russian Uranium Hinders U.S. Advanced Nuclear Reactor, Fuel Development

As Russia and China forge ahead with their advanced reactor designs, the United States is encountering trouble due to dependence on Russian supplies of high-assay low-enriched uranium (HALEU), a type of near-20% enriched uranium fuel that the U.S. lacks the capacity to produce. In fact, Russia is the world’s only commercial HALEU supplier. Although sanctions currently do not target Russian uranium exports, the fear of potential fuel supply disruptions has generated concerns among U.S. companies developing a range of advanced reactors.

As a more energy-dense fuel source, HALEU is indispensable to “nine of the ten advanced reactor designs” funded by the U.S. Department of Energy (DOE), including TerraPower’s Natrium, a 345MWe sodium-cooled fast reactor, and X-energy’s XE-100, a 80MWe fourth-generation high-temperature gas-cooled reactor. Consequently, the lack of a steady supply of HALEU can seriously undermine the United States’ ability to compete with Russia and China in the development of safer and more economically efficient next-generation nuclear power.

One short-term fix could be for the government to take weapons-grade uranium and blend down its enrichment level to below 20%. In the long term, however, the United States will have to establish its own commercial HALEU supply chain. To that end, the DOE announced earlier this month the establishment of a HALEU consortium to “help inform DOE activities to secure a domestic supply” of the key fuel. The Department has also signed a contract with Centrus Energy, a U.S. uranium product manufacturer, to deploy centrifuges at the American Centrifuge Plant in Piketon, Ohio, to build the first HALEU production facility in the country. The company has acknowledged, however, that “the initial capacity of the facility will be modest, subject to the availability of funding and/or offtake contracts.” This means that the United States cannot yet dismiss the prospect of dependence on Russia’s commercial HALEU supply, the urge to escalate sanctions notwithstanding.

The HALEU-dependent TRISO-X fuel particle designed for X-energy’s high-temperature gas-cooled reactor. The U.S. Nuclear Regulatory Commission (NRC) accepted an application from the company earlier this month to fabricate the fuel at a facility in Oak Ridge, Tennessee | Source: X-energy

Russia Bids for Saudi Nuclear Project, China Pledges Cooperation with Gulf States

Rosatom has submitted documents to bid for Saudi Arabia’s first nuclear power plant project, according to Russian Deputy Prime Minister Alexander Novak. The two countries have had an agreement on the peaceful use of nuclear energy since 2015, when Riyadh announced its intention to build 16 power reactors worth a total of $100 billion before 2030. The government plans for nuclear energy to make up 20% of the country’s overall consumption. The last time Rosatom submitted a bid for Saudi Arabia’s nuclear power projects was in 2018 against U.S., French, South Korean, and Chinese competitors.

When Chinese leader Xi Jinping attended the China-Gulf Cooperation Council (GCC) Summit in Riyadh earlier this month, part of his keynote address was devoted to nuclear energy cooperation. “A China-GCC forum on the peaceful use of nuclear technology and a China-GCC nuclear security demonstration center will be established,” Xi said. “China will provide training opportunities to GCC countries on the peaceful use of nuclear energy and technology.”

Xi Jinping speaking at the China-Gulf Cooperation Council (GCC) Summit in Riyadh, December 9 | Source: Xinhua/Chinese Foreign Ministry